The Lawsuit Arrived. But Is It Even Legal?

You open the envelope and feel your stomach drop. It is a debt collection lawsuit, demanding payment for a balance you barely remember. The amount seems inflated. The creditor’s name does not ring a bell. Worst of all, the debt is several years old.

You wonder if this is a sign that legal support may be in your best interest.

What most consumers do not know is this: You may not have to pay a dime. The law may no longer allow them to collect. That is the power of the statute of limitations on debt.

What’s the Statute of Limitations on Debt?

The statute of limitations is a state-specific law that limits how long a creditor or debt collector can sue you for repayment. Once that legal window closes, the debt becomes “time-barred.”

A time-barred debt is still a real obligation, but it is no longer enforceable through the court system. If you are sued for a time-barred debt and do not raise that defense, you may still lose the case by default.

Collectors may continue to contact you and ask for voluntary repayment. However, they cannot take legal action to enforce the debt if the statute has expired and you assert that defense properly.

Can I Still Be Sued for Time-Barred Debt?

They should not sue you, but some will. Debt buyers and collection firms may file lawsuits on expired debts, hoping the consumer either fails to respond or does not know how to raise the statute of limitations as a defense.

If you do not respond, the court can issue a default judgment. That judgment can lead to:

- Wage garnishment

- Frozen bank accounts

- Property liens

The court will not check the timeline for you. It is your responsibility, or your attorney’s, to raise the statute of limitations. Federal Trade Commission (FTC), suing or threatening to sue on a time-barred debt is often a violation of the Fair Debt Collection Practices Act (FDCPA).

State-by-State Time Limits

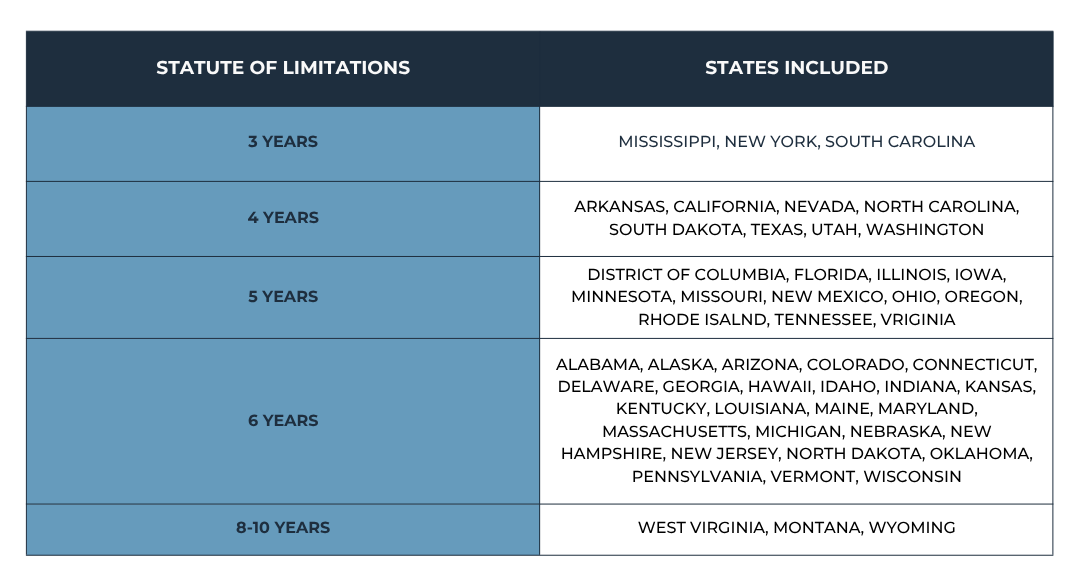

The statute of limitations for debt collection lawsuits varies by state and by debt type. For this article, we are focusing only on credit card debt, which is usually classified as a revolving or open-ended account rather than a written contract.

In many states, the legal timeframe to sue on unpaid credit card debt ranges from three to six years.

If you live in New York, Mississippi, Maryland, Virginia, Delaware, or South Carolina, the statute of limitations is typically three years from the date of default (usually after your last payment or charge). After that point, the debt may be time-barred.

States like California, Texas, Arkansas, Nevada, North Carolina, and Pennsylvania generally allow four years to file a lawsuit on credit card debt.

In Florida, Illinois, Missouri, New Mexico, Oklahoma, and Iowa, the limit is often five years, though some creditors may argue for longer if they claim a written contract applies.

Most other states—including Georgia, Michigan, Washington, Massachusetts, Colorado, and Minnesota—apply a six-year statute of limitations to revolving accounts. A few outliers, such as West Virginia, Montana, and Wyoming, allow longer periods—sometimes up to eight or ten years—depending on the classification and supporting documentation.

Note: These timelines apply specifically to revolving credit accounts. If a collector can provide a signed agreement with specific terms, courts in some states may allow a longer period under written contract rules. Always consult an attorney about how your debt may be categorized in your state.

Can the Statute of Limitations Restart?

Yes. And this is where many consumers make costly mistakes. In many states, the statute of limitations can restart if you:

- Make a partial payment

- Acknowledge the debt in writing

- Agree to a new payment plan

Even an unintentional action like making a small payment or replying to a collection notice in writing can reset the timeline, allowing the collector to sue again. Always consult a legal professional before engaging with a collector regarding an old debt.

What Happens If I Accidentally Restart the Statute of Limitations?

If you make a payment, acknowledge the debt in writing, or agree to a new payment arrangement, you may legally restart the statute of limitations. This means the collector could now sue you within a new time window. Because of this, never take action on an old debt without legal guidance.

Can a Debt Collector Report a Time-Barred Debt to Credit Bureaus?

Yes, but only if the debt is still within the credit reporting time limit. In most cases, that period is seven years from the date of first delinquency. Once the seven-year window passes, the debt should no longer appear on your credit report. If it does, you may have grounds to dispute it under the Fair Credit Reporting Act (FCRA).

Is It Better to Settle or Challenge a Time-Barred Debt?

If the debt is time-barred, it is usually better to challenge it rather than settle. Settling or agreeing to a payment plan may reset the statute of limitations and give the collector new grounds to sue. Challenging the debt legally and asserting your rights is often a safer path.

Can I Be Arrested for Not Paying an Old Debt?

No. You cannot be jailed for unpaid consumer debts. However, if a court has entered a judgment against you and you ignore further court orders, such as failing to appear at a debtor’s exam, you could face legal consequences for noncompliance. This is related to the court order, not the debt itself.

Can I Remove a Default Judgment for an Old Debt After It Is Entered?

Possibly. In some cases, you can file a motion to vacate the judgment if you can show that the debt was time-barred or that you were not properly served with notice. Each state has different rules and timelines, so legal assistance is strongly recommended.

Are Payday Loans or Medical Debts Treated Differently?

Yes. The statute of limitations often depends on the type of debt and how it is categorized. Medical bills may fall under written contracts. Payday loans may be considered oral or open accounts. The time limits may be longer or shorter depending on how the debt was incurred and documented.

Can I Dispute a Debt If I Already Made a Payment Years Ago?

Yes, but your ability to challenge the debt depends on when that payment occurred. A recent payment may have restarted the statute. However, you can still dispute errors in the balance, ownership, or legal standing of the debt regardless of past payments.

What Should I Do If I Am Sued for a Time-Barred Debt?

Do not ignore the lawsuit. Even if the debt is time-barred, failing to respond can result in a judgment against you. Take the following steps:

- Review the date of your last payment

- Check your state’s statute of limitations

- Do not acknowledge or pay the debt without advice

- Request full documentation of the debt

- File a timely response raising the statute of limitations

- Consult with a debt defense attorney

What Is Debt Validation?

If you are unsure whether the debt is real, collectible, or accurate, you have the right to request debt validation. This process forces the debt collector to prove that:

- The debt is legitimate

- The amount is correct

- They have legal authority to collect it

At Guardian Litigation Group, we include debt validation as part of our broader legal defense and debt resolution strategy. Although we do not offer validation as a standalone service, if your primary goal is to request validation before deciding what to do, we have partnered with SoloSuit specifically for this purpose.

Need a Debt Validation Letter? Try SoloSuit

If you are not facing a lawsuit but want to challenge the validity of a debt, SoloSuit offers an easy and affordable way to do so. SoloSuit helps consumers draft and send formal debt validation letters within the legal 30-day window, ensuring your rights are asserted early in the process.

Why Use SoloSuit for Debt Validation?

If you’re looking to challenge a debt before it escalates to a lawsuit, SoloSuit makes the validation process fast, simple, and legally sound. Their platform walks you through creating a formal Debt Validation Letter, ensuring it meets FDCPA requirements and is delivered on time.

SoloSuit helps consumers:

- Stop debt collection activity while awaiting verification

- Exercise their legal rights early in the process

- Avoid mistakes that could restart the statute of limitations

Whether you need time to investigate the debt, prevent further collection, or assert your rights without hiring an attorney, SoloSuit is a reliable first step.

Generate a Debt Validation Letter with SoloSuit

SoloSuit is ideal for individuals who are not yet ready for Guardian legal representation but need to stop collection activity or verify that a debt is legitimate before taking further action.

Disclaimer: The information provided in this blog article is for informational and entertainment purposes only and should not be construed as legal advice. It is not intended to create, and does not constitute, an attorney-client relationship. Every legal situation is unique, and readers should consult a licensed attorney for advice specific to their circumstances.

While this article may reference SoloSuit as a third-party tool for generating debt validation letters, SoloSuit is not affiliated with or operated by Guardian Litigation Group. We do not oversee or guarantee the services provided by SoloSuit. Readers are encouraged to perform their own due diligence before using any third-party service or relying on non-attorney tools to respond to legal matters.